- Point of view

Transforming B2B sales with digital CX: Three challenges you need to master

B2B technology sales has changed forever. With the shift to everything-as-a-service (XaaS) subscriptions, customers increasingly handle much of the sales process on their own and only reach out to a salesperson when they are ready to negotiate price. With the pandemic eliminating in-person sales visits, the consumer model of online purchases –eliminating contact with a salesperson entirely – is becoming the preferred experience for B2B customers. Tech firms, however, have been slow to make this shift, due to poor processes, a lack of technology, and perhaps most commonly, the cultural issues preventing a digital sales transformation.

Here we look at the progress made toward creating an end-to-end digital experience for B2B customers and share some of the challenges or roadblocks typically seen when talking to companies about their digital progress – or lack thereof.

Explore our sales and commercial services

Digital selling

Over the past few years, there have been tremendous investments made in configure price quote (CPQ) and e-commerce software to automate digital sales and enable self-service purchases. Today, 53% of B2B tech companies support the online purchase of subscription products, including initial purchases by new customers, and 40% of companies support the online purchasing of additional modules and user licenses. However, only a small percentage of sales close via a self-service model, and typically only smaller deals from smaller accounts.

If customers prefer online purchasing, and tech firms are enabling this, why aren't we seeing more use of e-commerce for larger enterprise deals? The single biggest roadblock we've seen is culture, as companies cling to legacy sales models with sales executives managing these deals. The sales executives tend to push back at efforts to automate or move deals online due to concerns they won't receive the same commission checks. Not only is this ignoring customer preference, but these larger deals also tend to involve more spreadsheets and manual processes and may have higher discounts and non-traditional bundles and configurations, which are ultimately less profitable to implement and support.

Vishal Talwar, high tech industry leader at Genpact, believes the second challenge is strategy and design. "A 100% self-service model requires a strategic shift with a heavy pivot on experience, but many firms have yet to design a digital customer journey that considers B2B client expectations when buying online. But the companies that are redesigning their digital customer journeys are transforming both their customer and employee experience."

The pandemic has certainly hastened the transition to digital sales, with 69% of companies saying they do not expect to see sales practices returning to the account-exec-based model used pre-COVID. Companies who continue to cling to these legacy models need to create a roadmap and timeline to transition to more automated and self-service selling.

Outcome-based selling

Another significant change to selling XaaS products is embracing outcome-based selling, focusing the sales process on identifying a customer's business goals (for example, the desired outcomes for the purchase), and then designing the selling motions (and ultimately the implementation and customer onboarding) to achieve these outcomes as rapidly as possible. However, this trend is not just about products. It also addresses service sales. In fact, developing outcome-based service offerings is the number-one business challenge over the past year for the Technology & Services Industry Association (TSIA) Service Offer Management research practice.

As customers increasingly focus buying decisions on which provider can produce the most rapid path to value realization instead of feature/function discussions, companies are responding with a move to this model. Although only 34% of companies say they are effective at outcome-based selling and are seeing measurable results today, 65% say shifting to selling outcomes (as opposed to features and functionality) is a high priority for 2022. This is going to require changes to both people and process.

One of Genpact's clients, a large software and cloud company, has embarked on a journey to redesign the end-customer experience at the point of purchase. Focusing on outcome-based selling is becoming a key strategic differentiator for many organizations.

Today, only 29% of companies strictly enforce salespeople to capture customers' desired outcomes, so this has yet to become embedded in sales processes. Additionally, only 14% of companies have changed hiring profiles for new salespeople to focus on outcome/value-selling skills. However, training is underway, and 42% of companies say they have provided outcome-based sales training for sales teams in the past 12 months.

Digital renewals

In a subscription economy, annual recurring revenue (ARR), or subscription renewals, are critical for success. With the high cost of acquiring enterprise customers, technology companies do not even typically realize a profit on a new customer until the first (or even second) renewal. Though customer success organizations are typically seen as the drivers of renewals (78% of CS teams say they have a charter of retention or renewals), this doesn't necessarily mean they own the renewal, as shown in figure 1.

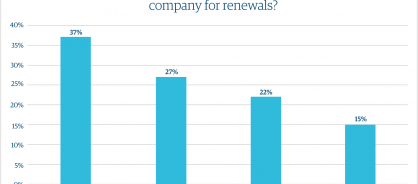

Figure 1: Who owns renewals?

Take a copy for yourself

More than one-third of the time, renewal specialists in the sales organization are responsible for closing renewal deals, and 27% of the time, this responsibility falls to the account executive. Customer success managers (CSMs) only own the renewal for 22% of companies. Historically, TSIA has found that renewal rates are higher when a renewal specialist or CSM is the owner because sales executives are typically compensated more for new business than renewals, so they have less of a focus (and skill set) for retention motions.

As with the initial purchase, buyers increasingly want to complete the renewal process online. In fact, only 5% of customers want contact via a phone call for upcoming renewals. The rest prefer that digital contacts (either by email with documents attached or links to a web portal) review and sign agreements or direct integration to ERP systems for fully automated approvals and billing. However, only 27% of technology companies today enable online automated renewals, and for those who do offer this, more than half, 57%, say that less than 20% of renewals transact digitally. Why is this number so low? Though cultural problems and fear of change are common challenges, as it is with moving to fully digital sales, many companies are still trying to understand how to manage renewals successfully. This includes:

- Health scores. Creating accurate health scores to identify which accounts are likely to renew and can choose an automatic option, and which accounts may prove more resistant and require manual intervention, continues to challenge most firms.

- Renewal timing. More than a third of companies, 37%, start renewal activities 90 days prior to the renewal, 22% start 120 days out, and 19% start 180 days out. Understanding the correct cadence is critical before they can automate renewal campaigns.

- Expand selling. On average, 30% of technology subscription renewals include an upsell, and the average expansion rate is 21%. For pacesetters, 54% of renewals include an upsell, with an average expansion rate of 27%. Companies that depend on making expand selling part of the renewal conversation but fear introducing too much automation may prevent the identification of additional revenue opportunities.

Whether they own the renewal and expand selling opportunities or only contribute to them, CSMs must improve their sales acumens. To address this, about 35% of companies have provided selling skills (prospecting, negotiation, closing, and so on) in the past 12 months.

Make sure you're delivering an exceptional, low-effort customer experience

As you look for opportunities to bring more digital capabilities and automation to your sales and renewal activities, here are some recommendations to keep in mind.

- Understand and improve the end-to-end customer journey. The move to XaaS is forcing companies to break down silos and view the end-to-end customer experience for the very first time – 55% of companies say their customer success organization has executed a customer journey mapping exercise, typically involving sales, support, marketing, professional services, and product management. Interestingly, only 5% of companies say they have involved customers in the journey mapping exercise. Make sure you aren't building the ultimate customer journey in a vacuum. For example, Genpact helped a $30 billion+ medtech company design an end-to-end customer experience using its customer experience, sales experience, complexity, and risk (CSCR) methodology. This created a holistic CX index for the find-buy-engage-use-renew value chain using both objective KPIs and the subjective voice of the customer scores. It pinpointed areas of improvement across sales, marketing, customer service, and the supply chain and provided the best next actions to improve the CX

- Invest in technology to better understand customer health and improve retention. Pacesetters are embracing sentiment analysis across voice, email, chat, and other digital conversations to identify friction points impacting customer success and customers who are clearly frustrated and need intervention from their success or account manager. Though CSMs may think they have a great understanding of an account, they don't always know about conversations happening with other parts of the organization, and in an omnichannel world, a customer's history doesn't capture every conversation correctly. Genpact's Dipanjan Das, sales and commercial service line leader for cloud, high tech, and media, observes, "Achieving sales success means understanding the weaknesses that cause churn at multiple stages of the renewals cycle. And the simple fact is that unless you address these issues with the right processes, technologies, and analytics, you'll never be confident that you have a sustainable pool of customers." For example, Genpact worked with a networking company moving to an as-a-service sales model and set up a data and technology solution to improve renewals by capturing signals from across the customer lifecycle. CSMs now have insights across presales, adoption, and customer service, and renewals and expand selling are up 15% in the first two years.

- Do better correlations on impacts to success. With oceans of information about accounts, contacts, implementations, technology adoption, business challenges, support interactions, and other enterprise conversations, companies need to do a better job of analyzing and correlating customer knowledge and information to derive insights into specific activities that positively or negatively impact account health. Armed with more insight and intelligence, companies will understand the experiences proven to drive renewals, expand wallet share, and provide contextual advice to employees to guide each interaction toward the most profitable outcome for both the company and the customer

The authors of this point of view are:

- John Ragsdale, VP of technology ecosystems, TSIA

- Dipanjan Das, sales and commercial service line leader for cloud, high tech, and media, Genpact

- Vishal Talwar, high tech industry leader, Genpact