- Point of view

How major consumer goods companies can maximize profits on Amazon

Four guiding principles for success

In 2020, as the pandemic kept us home, more than 2 billion people worldwide bought goods or services online, spending $4.2 trillion.

Amazon is capturing a big chunk of this spend, reporting $108.5 billion in sales in the first three months of 2021 alone, up 44% from a year earlier.

No wonder brands and merchants are scrambling for prominence on Amazon. They know how important it is to get as much exposure as they can on the platform to ensure they get their products into consumers' hands quickly. But they need to do it cost-effectively.

Too often, businesses find that their profits erode if they choose the wrong mechanism for selling their goods or if they fail to comply with the platform's changing requirements. Other issues with promotions, shortages, pricing, and penalties can result in revenue leakage of as much as 35%.

However, companies can overcome these challenges if they have a 360-degree view of their partnership with Amazon and follow a four-pronged approach to managing the relationship.

Take a copy for yourself

1. Choose the right Amazon program

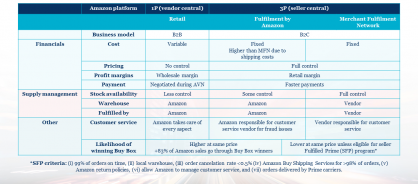

First, it helps to understand the terminology Amazon uses. The company's vendors are brand-name manufacturers from whom it buys products directly to sell under its own name. That's called the business-to-business (B2B) or first-party (1P) model. Amazon sellers are manufacturers that use Amazon as a marketplace, maintaining ownership of their goods until they sell them to a consumer – the business-to-consumer (B2C) or third-party (3P) model.

Determine which model is right for you

There are pluses and minuses to each approach. Vendors who turn over all responsibilities to Amazon sacrifice certain controls. Amazon doesn't always meet minimum advertised pricing guidelines from manufacturers when it sets prices using its own algorithms. That can result in lower margins for the manufactures. And during Amazon's annual vendor negotiations process, it aggressively seeks to recoup its operating costs. This can eat away at vendors' margins if they don't make a strong case for themselves. In addition, purchase orders from the company can fluctuate, causing planning inefficiencies.

Amazon sellers face disadvantages, too. Although they maintain ownership of their goods until they sell them, they must assume the substantial cost of handling daily operations and are more dependent on their brand's reputation to turn page visits into sales. Another downside: sellers are less likely to feature on Amazon's Buy Box, a call to action for consumers. Based on our experience, Buy Box winners capture purchases more than 82% of the time.

Here's what happened to one Genpact client, a food and beverage company that was using the vendor option, deciding for itself the number of cases it would ship to Amazon. SKU mismatches infested the firm's data. As a result, it had to cancel half its orders during a single period, and chargebacks were eating into profits. There were ongoing issues over advance shipment notifications, electronic invoices, purchase orders, bills of lading, and more. These problems cut into revenue by 23%.

To help, an implemented master data management cleanup paired Amazon barcode, weight, and dimension rules with our client's. Automated catalog management alerts that refreshed in real time were installed.

Next, cost and freight analytics and devised process enhancements were conducted for getting the goods out the door, embedding drawings of Amazon labels into the system.

Finally, detailed data helped steer traffic toward high-performing carriers. And the new system helped our client renegotiate carrier contracts. As a result, chargebacks fell by 68% within six months.

Clearly, there are benefits and drawbacks to both systems – so how do you know which is right for your company? Start by answering these questions:

- What is your overall business objective?

- How are you bringing together your online and offline strategy?

- How strong are your customer service capabilities?

- How much control over pricing, inventory, and branding do you want to maintain?

- What is your current operational volume? Can you nimbly adjust when demand fluctuates?

- How mature, flexible, and at the ready is your supply chain?

Your answers will determine the merchant model you should choose. For instance, if you need full control of supply chain management and don't mind taking on the responsibility of customer service, you should consider the merchant fulfilled network model.

2. Pull the right value levers to optimize growth, profit, and cash flow

Six factors – or levers – can have a powerful influence on your company's growth, profitability, and cash flow. The best strategies work when you pull all six levers. But even the effective use of just one can improve profits and efficiency.

Here's a checklist covering each lever and the elements within them that contribute to business success – or failure – on Amazon.

Six levers of success

3. Work with a closed-loop system

Regardless of whether you choose the vendor or seller model, we recommend a closed-loop management system. The closed-loop approach guides and monitors activities such as inventory levels, production schedules, and supply chain functions – and it does so in real-time. The information it amasses is based on feedback from operations across many business units rather than on stagnant forecasts or orders. You can use it to predict where revenue loss is likely to occur, then move proactively to prevent this from happening.

Using a closed-loop system

The beauty of a closed-loop system is that by taking corrective measures, you have sharp insights at hand to protect your interests when you're negotiating with Amazon. A plan-to-cash mindset when designing internal processes drives efficiencies and lean operations.

In one instance, the closed-loop system we implemented for a consumer goods company resolved deduction root causes successfully. As a result, it eliminated time-consuming settlement discussions so that our client could focus on growth rather than conflicts.

4. Build Amazon-specific analytics and insights

KPIs are critical to decision-making, especially when working with Amazon, where its tough negotiation stance requires companies to have 360-degree visibility of their business.

We advise three techniques to foster analytics and insights that will strengthen your relationship with Amazon:

- Build processes that are agile and flexible to increase your reaction times

- Build governance that supports those processes for quick decision-making

- Think integrated: bring together upstream/downstream challenges to form a closed loop

E-commerce is a data-rich environment. To succeed, brands must institute KPIs across the entire value chain. However, many firms do tend to track KPIs in isolation. This in what's known as “double counts”, meaning that Amazon will penalize suppliers for both shortages and promotions of stock it claims never arrived. Connecting the dots across metrics can reduce overall revenue leakages and inefficiencies.

Other factors can make the difference between success and failure on Amazon as well. One company we worked with was losing market share because customers couldn't find its products using the Amazon search tool. Plus, some products had negative reviews. Our approach was to access Amazon's data for insights on how customers searched for our client's products and how products sold geographically, and to learn about alternate purchasing behavior.

With this information, we revised our client's promotional strategy to increase traffic to its products. We also informed Amazon when its search issues failed to turn up the products or its delivery problems caused negative reviews. This helped resolve inefficiencies and ensured our client wasn't unduly charged. As a result, conversion optimization boosted net sales by roughly 3%.

When you monitor information effectively, you know which levers to pull. You have a systematic way of identifying the most valuable and efficient use of resources and can align your goals to your success.

Genpact can help your enterprise navigate Amazon, putting you in control of the wheel so you can drive your business to reach higher profits.

This point of view was co-authored by Guido Castagnola, Connected Commerce Transformation Director, Genpact; and Phani Solomou, Connected Commerce Lead Partner – Consumer Products, Life Sciences, and Healthcare, Genpact.